6 IPO Questions for the Stock Market newbie

Have you been considering investing in IPOs in India? In this article, we look at 6 important questions you as a retail investor should know.

In the Indian stock investing community, IPOs are selling like hot cakes. The optimism is infectious and certainly crazy on occasions.

Take the Alpex Solar IPO for instance. The issue size was to raise Rs. 74.52 Crores (approx USD 9 million). The price band was Rs 109-115. The retail segment was oversubscribed by 352 times. It opened in NSE at a whopping INR 345! And this is not a standalone story. Consider Divyansh Laboratories that was oversubscribed 107 times and Craftsman Automation that was oversubscribed 72 times, for example.

So, here are a few questions to answer:

- Are there different types of IPOs?

- How can I find the IPOs?

- How to estimate opening performance of an IPO?

- How to assess long term performance of the company?

- How to maximize chances of allotment?

- When should you exit from the stock?

Are there different types of IPOs?

Yes. There are at least two. SME IPOs and Mainboard IPOs. SME IPOs were instituted by BSE in 2012 and the NSE launched NSE Emerge (SME Listing platform) the same year. This was done to allow SMEs that did not meet requirements of larger companies to access the market.

SME IPOs provide a way for small and medium companies to raise capital for expansion, innovation, and working capital needs. Naturally, as much as the growth prospects SMEs offer, similarly the risk involved in such companies are also high and need due diligence.

While SME IPOs have a large retail investor focus, large Mainboard IPOs tend to attract more institutional investors, including Mutual Funds, insurance companies etc.

How do I find IPOs and How do I apply for them?

If you have an account with a broker, typical broker platforms allow you to invest in IPOs through them. They often list upcoming IPOs. Below is a screenshot from Zerodha.

How to estimate the opening performance of an IPO?

There is no accurate way to do this. However, you should definitely leverage two metrics:

1. Subscription Ratio

The over-subscription ratio, indicating how many times the offered shares were subscribed to by investors, is a key metric. A high over-subscription suggests strong investor interest, potentially leading to a higher opening price. However, it doesn't guarantee a sustained price increase.

If you are tracking the subscription status of an IPO during the time it is open for subscription a simple Google search will give you the status.

2. Grey Market Premium (GMP)

The grey market is an unofficial platform where investors trade IPO shares before they officially list. A high grey market premium can indicate anticipated strong demand and a potentially higher opening price. Be cautious about this source as it's unregulated.

Personally I have found GMP to be effective in my limited experience.

You can find the GMP on many portals. I use Investorgain, which I have found to be useful. Consider SKFL from the screenshot about open between the 6th and 11th of March, 2024. Here is the GMP rates on Investorgain.

The IPO price is 227 and the Grey Market is putting a premium of INR 250 on top of it. This puts a tentative listing price of SKFL on the day of opening at around INR 477.

That said, this is not an indicator of continued growth or a guarantee of the listing. It is a proxy indicator of the possible opening.

How to assess long term performance of the company?

This question poses the challenge of being able to assess the long term future of the company. And certainly this is no easy task.

More on this will be elaborated in later posts. However, suffice it to say at this point that you should consider the following aspects:

(a) Your assessment of the future of the sector in which the company operates. Broad indicators include if the sector is a Government or Investment focus area.

(b) Financial and Operational metrics of the company.

(c) Who are the current investors in the company.

(e) What is the status of debt in the company.

(f) An assessment of the business model.

It is very likely that your initial assessments may fall short of reality. At this point take help from Youtube videos - not to blindly follow them - rather to learn from how they approach the topic.

I would not hesitate to acknowledge that much of my learnings have come from following videos and approach of such people. However, when you do so - instead of looking for someone who will give you foolproof advice, try to see what you can understand from their approach. It is possible that they may be erroneous in their judgement as well.

How to maximize chances of allotment?

There are not any to my knowledge. The only variable that you can control is if you want to invest in the Retail or HNI (High Networth Segments).

Typically an IPO has dedicated allocation to both these segments and therefore the subscription ratios in both segments differ.

From the investors perspective, the difference lies in the amount of investment. Anything less than INR 2 Lakh is retail category. Anything more than INR 2 Lakh falls in the HNI category. However there is no upper limit for HNIs. HNIs participate in NII (non-institutional investors) portion of the IPO.

That is the only choice you may make. Personally, applying in either segment has not helped me in getting any better results. However, in theory it is possible to alter changes to your favour by looking at the subscription status and size of the HNI and Retail segments in an IPO.

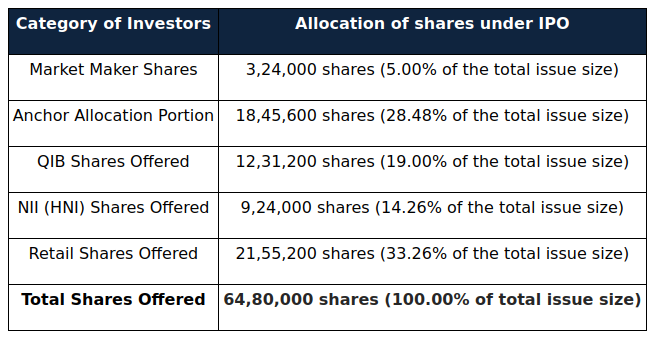

For example, if you look at the structure of Alpex Solar IPO allocation structure:

You notice the difference in the shares on offer in both NII and Retail segments. Alongwith your planned investment amount, you may consider the segment size as above and the present subscription ratio status to take a more informed decision to maximize your chances.

When should you exit from the stock?

There is no easy answer. Investing in an IPO purely for the profits that may be available at a premium listing is a strong attraction. So you may choose to invest with a mindset of immediately capturing the premium amount on the first or first few days of listing.

On the other hand, if your research of the company makes you bullish for longer term returns then you should probably hold for the future.

Summarily, note that there are no guaranteed answers for any of these questions. These are only the best indicators that we have discovered this far.

Do comment if you would like us to dwell on any particular aspect on IPOs.