Factors to Consider When Buying Mutual Funds in India

It's essential to pay attention to critical aspects such as investment objectives and strategies, fund performance, quality of management, fees and expenses.

Table of Contents

Introduction

Understanding Mutual Funds

Essential Factors to Consider

- 3.1 Investment Goals

- 3.2 Risk Tolerance

- 3.3 Time Horizon

- 3.4 Fund Performance

- 3.5 Expense Ratio

- 3.6 Fund Manager

- 3.7 Investment Style and Strategy

- 3.8 Liquidity

- 3.9 Tax Implications

Categories of Mutual Funds

How to Invest in Mutual Funds

Common Mistakes to Avoid

Conclusion

Frequently Asked Questions

Introduction

Investing in mutual funds is an increasingly popular option for individuals looking to build wealth in India. With the promise of higher returns compared to traditional savings accounts and fixed deposits, mutual funds offer flexibility and diverse investment opportunities.

However, the wealth of options available can be overwhelming for new investors. In this article, we will explore the crucial factors to consider before buying mutual funds in India, ensuring you make informed decisions that align with your financial goals.

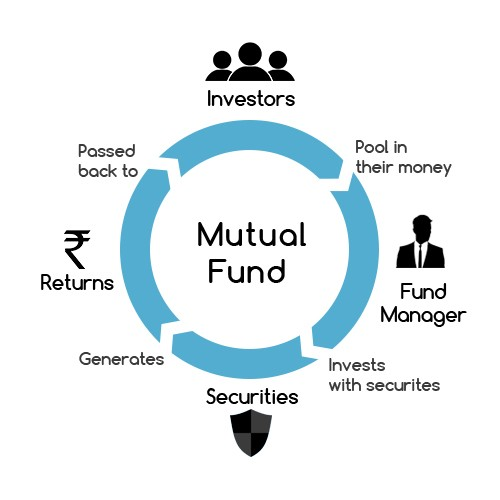

Understanding Mutual Funds

Mutual funds are investment vehicles that pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities. Investors buy shares in the mutual fund, and the returns generate from the fund’s overall investment performance.

The major benefits include professional management, asset diversification, and affordability in terms of minimum investment amounts.

The mutual fund market in India is regulated by the Securities and Exchange Board of India (SEBI), which ensures that mutual funds operate in a transparent and ethical manner.

Essential Factors to Consider

Before diving into mutual fund investments, several key factors should guide your selection process:

3.1 Investment Goals

Identifying your investment goals is paramount. Are you investing for retirement, a child's education, or a major purchase? Understanding your purpose will help you select the right mutual fund that aligns with these objectives.

For instance, if your goal is long-term wealth accumulation, equity mutual funds may be a suitable choice. However, if you need liquidity or wish to preserve your capital, consider debt mutual funds.

3.2 Risk Tolerance

Your risk tolerance defines the level of volatility you can withstand in your investment portfolio. This is influenced by factors such as your financial situation, investment horizon, and personal comfort.

If you have a high-risk appetite, equity funds that invest in stocks could be appropriate. Conversely, if you prefer stability, conservative investments like fixed-income mutual funds may be more suitable.

3.3 Time Horizon

The time horizon is critical in determining the types of mutual funds to invest in. Short-term investments may not absorb market fluctuations as effectively as long-term investments.

Generally, the longer your investment horizon, the more risk you can afford to take, which can result in more significant potential gains.

3.4 Fund Performance

Past performance is a key consideration when choosing a mutual fund, as it can offer insights into how well a fund has managed various market conditions.

However, it’s essential to note that past performance doesn’t guarantee future results. Look beyond short-term performance and examine performance over at least five years, considering how the fund stacks up against its benchmark and its peers.

3.5 Expense Ratio

The expense ratio represents the annual fees charged by mutual funds to cover operating costs and management fees, expressed as a percentage of the fund's average assets. Lower expense ratios can enhance your returns over time, especially in the case of long-term investments. Always compare expense ratios among similar funds to ensure you’re getting good value.

3.6 Fund Manager

A fund manager's experience and performance history plays a crucial role in the fund's success. Research the fund manager’s track record, investment philosophy, and experience. A skilled fund manager can make a significant difference in achieving your investment goals.

3.7 Investment Style and Strategy

Understand the investment style (active vs. passive) and strategy (growth, value, blend, etc.) employed by the fund. Active managers seek to outperform the market through strategic buying and selling, while passive funds merely aim to replicate market performance. Your preferences and risk tolerance should align with the fund’s investment style.

3.8 Liquidity

Liquidity is the ease with which you can convert your mutual fund investments into cash. Open-ended mutual funds provide high liquidity, allowing you to redeem your investments anytime at the prevailing Net Asset Value (NAV).

However, closed-end funds may impose restrictions on redemptions. If you foresee the need for quick access to your funds, prioritize liquidity in your choice.

3.9 Tax Implications

Different types of mutual funds have varying tax implications. For example, long-term capital gains on equity mutual funds (held for over a year) are taxed at 10% for gains beyond ₹1 lakh, while debt funds (held for over three years) benefit from indexation.

Understanding the tax ramifications can significantly impact your net returns. Always consult a financial advisor if you’re unsure about tax implications.

Here's a Youtube video from CNBC covering this topic -

Categories of Mutual Funds

Mutual funds in India can be categorized based on various criteria. Some primary categories include:

- Equity Funds: Invest primarily in stocks. Suitable for investors with higher risk tolerance and long-term goals due to their potential for high returns.

- Debt Funds: Invest in fixed-income securities like bonds and government securities. Ideal for conservative investors focusing on capital preservation and regular income.

- Hybrid Funds: Combine equity and debt, catering to both growth and stability. Perfect for balanced risk-reward strategies.

- Tax-Saving Funds (ELSS): Equity-linked savings schemes offer tax benefits under Section 80C of the Income Tax Act while being subject to a three-year lock-in period.

- Index Funds: Aim to replicate the performance of a specific index, offering a low-cost passive investment option.

How to Invest in Mutual Funds

Investing in mutual funds in India can be done via several channels:

- Through Asset Management Companies (AMCs): You can buy mutual fund units directly from AMCs, either online or offline, by filling out a form and submitting KYC documents.

- Online Platforms: Many financial services platforms and apps allow investors to compare and purchase mutual funds conveniently.

- Robo-Advisors: These digital platforms provide automated, algorithm-driven investment advice based on your financial goals and risk appetite.

- Banks and Financial Advisors: Banks often provide mutual fund services, and professional advisors can guide asset allocation and fund selection.

To start, ensure you have your KYC (Know Your Customer) documentation in order, which usually includes identity proof, address proof, and a passport-sized photograph.

Common Mistakes to Avoid

Investing in mutual funds can be rewarding, but avoiding common pitfalls can ensure optimal returns. Here are a few mistakes to avoid:

- Ignoring Risk Tolerance: Investing in high-risk funds despite low-risk tolerance can lead to panic selling in market downturns.

- Chasing Past Performance: Don’t choose funds solely based on past performance metrics—consider current market conditions and future potential.

- Neglecting Diversification: Investing all your money in one fund can lead to significant losses; diversification across different funds reduces risk.

- Overlooking Costs: High expense ratios can eat into your returns. Always consider the cost implications of your investments.

- Lack of Regular Monitoring: Your financial situation and goals may change. Regularly review and adjust your portfolio to align with your circumstances.

Conclusion

Investing in mutual funds can be a worthwhile endeavor for building wealth in India, but it's essential to approach it with careful consideration. By understanding your investment goals, risk tolerance, and other essential factors, you can make informed decisions that align with your financial aspirations.

Remember to diversify your portfolio to minimize risks and keep an eye on performance, expenses, and changes in your financial circumstances to achieve optimal results.

Whether you're a seasoned investor or just starting, following these guidelines will position you to effectively navigate the thriving mutual fund landscape in India.

Frequently Asked Questions

1. What is the minimum amount required to invest in mutual funds in India?

The minimum investment amount varies by fund. Many mutual funds allow investments starting from as low as ₹500.

2. How are mutual fund returns calculated?

Returns on mutual funds are typically calculated based on the increase in Net Asset Value (NAV) over time, factoring in dividends reinvested and fees.

3. Are mutual fund investments safe?

While mutual funds are regulated, they come with market risk. Equity funds are riskier than debt funds; understand your choices before investing.

4. How can I redeem my mutual fund units?

You can redeem your mutual fund units by submitting a redemption request to the fund house or through your investment platform.

5. What is SIP, and how does it work?

SIP (Systematic Investment Plan) allows investors to invest a fixed amount regularly in mutual funds, making it easier to build a disciplined investment habit over time.

By addressing these crucial factors and questions, you're set to embark on a successful mutual fund investment journey in India.

Further Reads

- Bajaj AMC - Factors Affecting Investment DecisionsThis resource outlines eight critical factors for Indian investors, including risk tolerance, past performance, fund categories, economic conditions, costs, investment horizon, regulatory environment, and the influence of professional advice.Read more here 1.

- Paytm - Factors You Must Consider Before InvestingThis article emphasizes the importance of understanding risk tolerance, fund performance, net asset value (NAV), expense ratios, and the experience of fund managers when selecting mutual funds.Explore the details 2.

- Share India - Key Factors for SIP InvestmentsThis guide focuses on setting financial goals and understanding time horizons, alongside evaluating fund performance and the experience of fund managers as essential considerations for Systematic Investment Plans (SIPs).Learn more here 3.

- HDFC Bank - Factors Affecting Mutual Fund Investment DecisionsThis article discusses various factors influencing mutual fund performance, such as market fluctuations and liquidity, while also advising investors to align their choices with their investment objectives and risk appetite.Read the full article 5.

- DSP Mutual Fund - Key Factors to Consider Before Choosing a Mutual FundThis resource provides insights into investment objectives, risk-reward profiles, performance evaluation, tax impacts, and fee structures that should be considered when selecting mutual funds.Check it out here 6.