How to invest in US stocks using INDMoney App?

You can buy US stocks and ETFs from India directly through INDmoney. Take advantage of fractional trading and start your US investment journey for as little as $1.

By investing in US stocks, you are diversifying your investment portfolio. INDMoney App, makes it super easy to invest in the US stocks. This guide will take you through the steps involved in investing in US Stocks from INDMoney.

Let us first start with an important question.

Is it safe to invest using INDMoney App?

The short answer is YES, INDMoney is 100% Safe and Secure!

Three main reasons why I say this is -

- I have been using this app since 2022 and never had any issues. 😄

- On a serious note though, INDMoney is regulated by Securities and Exchange Board of India (SEBI). So all the transactions on the app are monitored by SEBI. 🛡️

- INDMoney uses 256-bit encryption and uses secure protocol SSL to secure your data so your investments are in safe hands. 🔑

Steps to invest in INDMoney App?

Here is a step-by-step guide on how to invest in US stocks using the INDMoney App:

Download and install the app from the Playstore (Android) or AppStore (iOS) by searching "INDMoney". If you like using your desktop, browse to https://www.indmoney.com/login on your laptop or computer.

You can also use my referral code to create an account. Download the INDMoney App from this link (The link contains my referral code). On funding your account with more than ₹ 5000 you would receive apple stock worth ₹1000.

Now create an account with INDMoney by providing your personal details like name, email and your KYC details like Aadhar Card or PAN Card.

Now link your bank account with your INDMoney Account. Why do it? Simple, you would need a bank account to fund your INDMoney so that you can make investments in US stocks. To add your bank account, provide details like Account Number, IFSC Code and MICR Code.

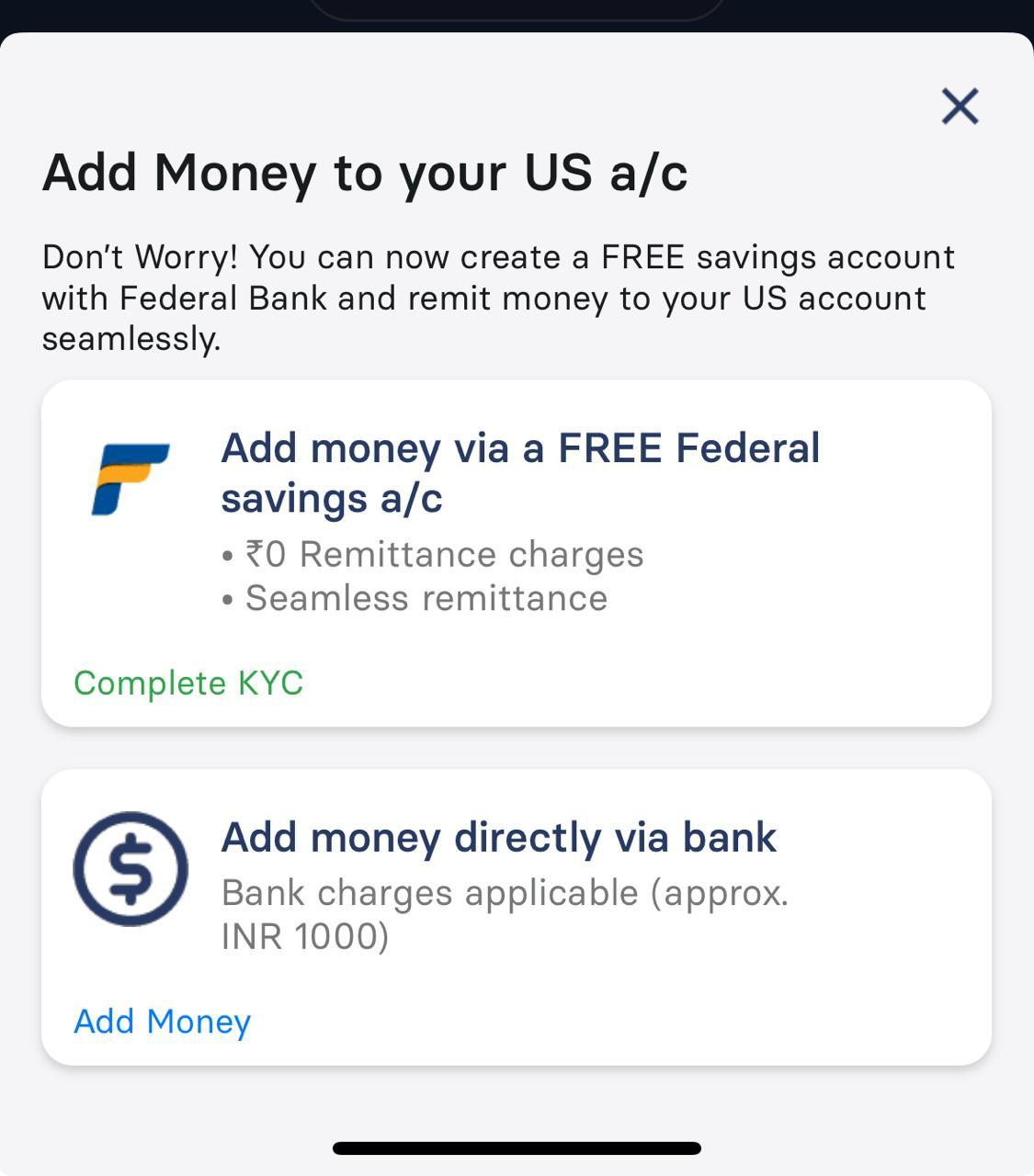

It's time for some action now. From the Dashboard, click on Assets >> US Stocks to reach the US Stocks screen. Click on Add Money to fund your account. You can add money in two ways -

- Create a FREE Savings Account with Federal bank and add money to it.

- Transfer money from your Indian bank to INDMoney US account (this will invite charges of ₹1000)

Go ahead and select a US stock that you wish to invest in. You can either search for the stock by its company name (like Meta or Amazon), or with its symbol (GOOG). INDmoney has Collections like Top Tech, US Baskets etc that have group of similar stocks (Top Tech has Microsoft, Apple, Netflix etc) and Sorting options (based on Market Cap, Name, Returns, Prices, Analyst Rating) so that you can browse through the list of available stocks and make the right choice.

Once you have selected the stock, Click on "Buy" and specify the amount in dollars or quantity in number that you wish to invest and click on the "Place Buy Order" button. Your investment will now be processed and you will receive a confirmation push notification or WhatsApp message once the purchase is complete. That's it, your first investment is done! ❤️

You may still have a few more questions about INDMoney, so why wait, let's address them.

What features does the INDMoney App provide?

While INDMoney is popular among Indian investors as it provides you the ability to invest in multiple assets like Mutual Funds, FDs etc, here are some interesting and useful features of the INDMoney App:

- Real-time tracking of stock prices and market movements

- Family Account - Manage All your Family Accounts in one place

- Ability to create and manage investment portfolios

- Detailed analysis of individual stocks and sectors

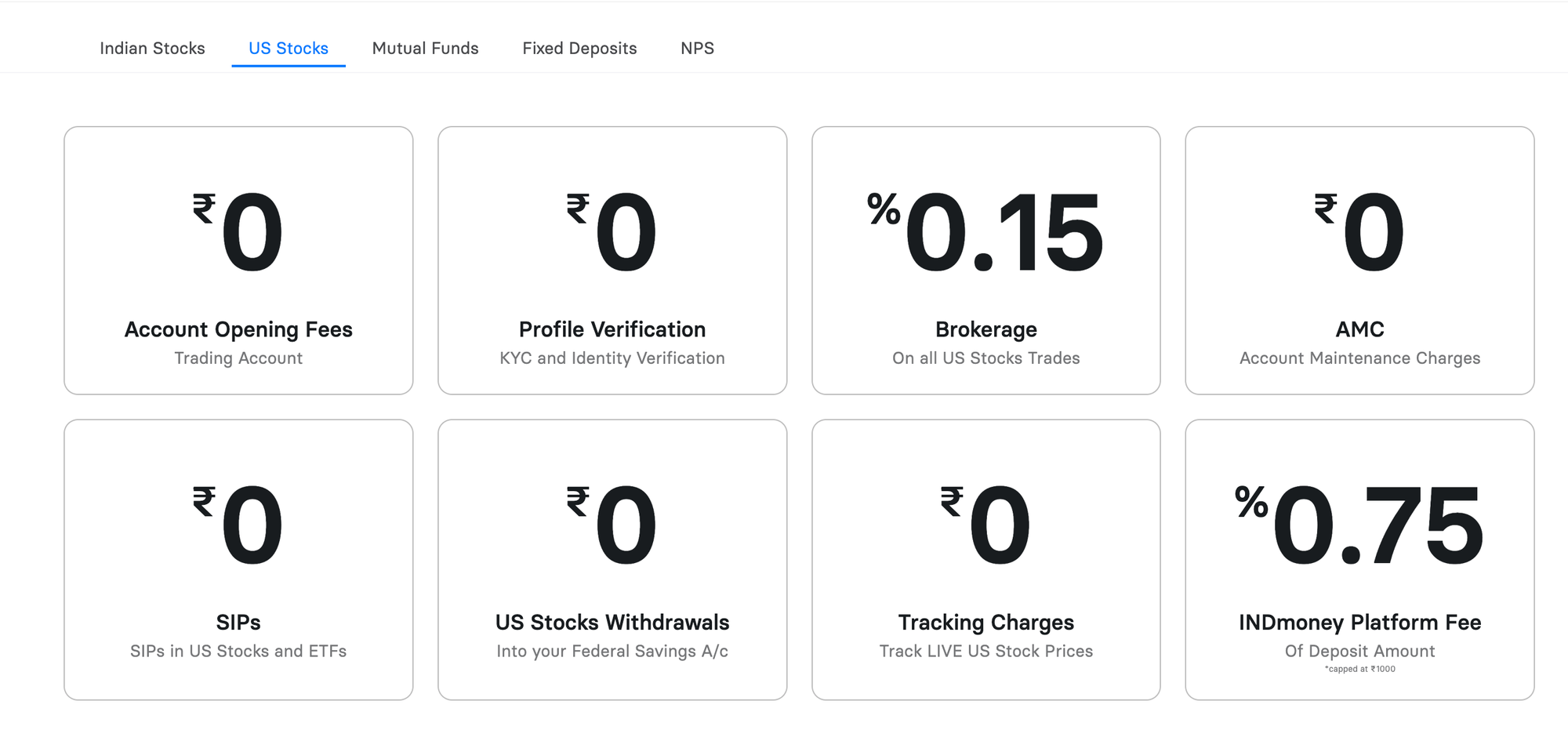

How much does INDMoney charge per transaction?

The charge is 0.00325% of transaction value for all stocks.

For BSE, The charge depends on the group of the traded stock, and is as follows : Stocks part of Group A,B,E,F,FC,G,GC,I, and W are charged @ 0.00375% of transaction value.

US Stocks are charged with the brokerage fee is 0.15% and the the platform fee is 0.75%

You can look at the pricing page at https://www.indmoney.com/pricing?type=us-stocks

Can we withdraw money from INDMoney?

Yes ofcourse. You can withdraw all your profits from INDMoney. Withdrawal happens with ACH transfer.

This is the standard electronic transfer method, sending funds directly to your linked bank account in India. Transfers typically take 2-3 business days.

Conclusion

So, that is how you can invest in US stocks using the INDMoney App. ✌️ Hope you like the article!

Happy Investing 😄