Suzlon: Stock Outlook? Part I

A case study of Suzlon. We dive into the past of Suzlon and attempt to understand if one should buy or sell the share and where the company is headed in the longer term.

About Suzlon:

Suzlon is primarily engaged in the business of manufacturing of wind turbine generators (‘WTGs’) and related components of various capacities. Suzlon is the largest Wind Energy player in India, generating

Source Screener.in: Company is a renewable energy solutions provider and is in the business of manufacturing, project execution and operation and maintenance of wind turbine generators and sale of related components. It has installed 20+ GW of wind energy in 17 countries and 111+ wind farms with a capacity of 13,880 MW. Company client portfolio includes power utilities and electricity producers in both the private and public sectors.

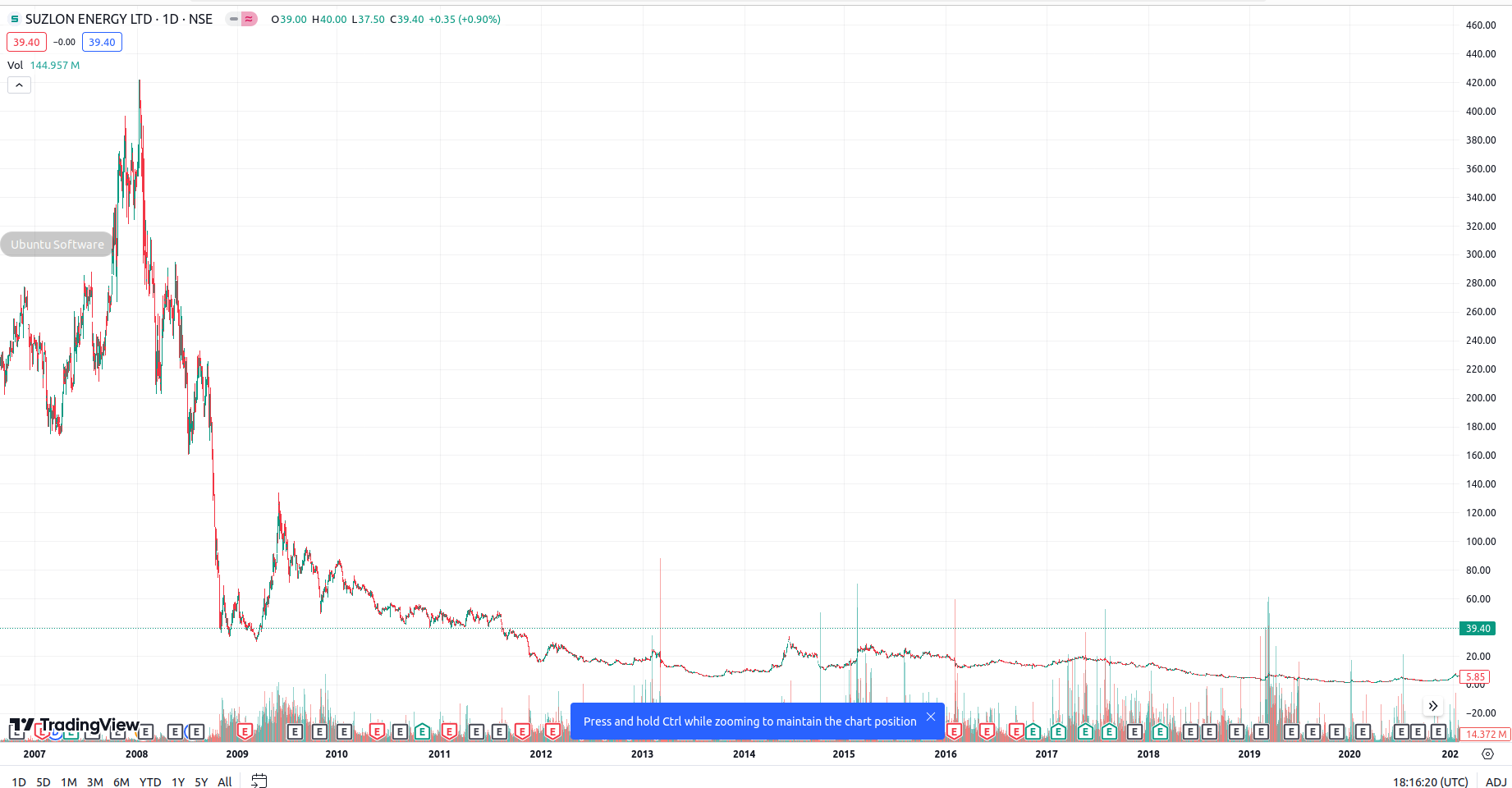

All time price history of Suzlon is below:

Understanding the context of Suzlon: From ₹400 to a Penny Stock

Back in 2008, Suzlon was trading at its all time high of more than ₹400. This was prior to the crash of 2008. Within the next year, it crshed to less than ₹50. By 2018, it further crashed to less than ₹10.

The continuous decline in the market value of Suzlon was due to its aggressive expansion plans, and its inability to rapidly growing debt. The interest rates grew increasingly difficult to service due to the global financial crisis following 2008.

Acquisitions that proved hard

Hansen Transmission: In 2006, Suzlon acquired the Spanish Gearbox company, Hansen Transmission for a huge USD 565 million! The hefty price strained Suzlon's finances and the cultural assimilation also proved difficult.

The Hansen acquisition is often cited as a contributing factor to Suzlon's financial troubles in the late 2000s. The high cost, integration difficulties, and gearbox reliability issues put a significant strain on their resources and ultimately hindered their growth.

Repower: Suzlon acquired the German wind turbine manufacturer Repower in 2007 for an equity valuation of USD 1.84 billion. This acquisition aimed to expand their product portfolio and geographic reach. However, integrating Repower's operations proved challenging, and Suzlon eventually divested the company in 2012.

Ensuing Financial Strains

The acquisitions proved hard to assimilate and the global financial crisis of 2008 aggravated matters. For the next 15 years, the debt left visible dents on the financials of the company and progressively brought down the prices to less than ₹10, until recently.

Developments over last 1 year

From less than ₹10, Suzlon climbed up to nearly ₹50 in a span of 12 months!

So what happened in this period?

What happened since May 2023?

Summarily, 2 important factors:

- Strong Annual Results

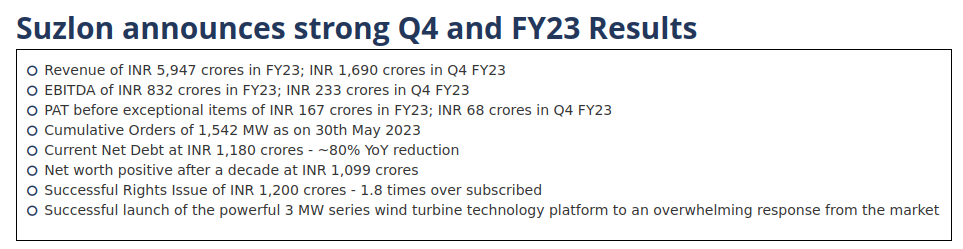

2023 Annual Results: Suzlon 2023 results were announced on May 30th, 2023. This was followed by a strong rise in its stock prices that went up about 7 times over the next 12 months.

Primary drivers in the results:

Suzlon was finally coming out of its debt. Notice the reduction in its borrowings in FY 2022-23.

Strong overall financials:

- Strong Investor Sentiment over Macro-Economic Renewable Energy

The present government has reiterated its strong commitment to renewable energy and its growth. The overall projection of Wind Energy capacity by 2030 is projected to more than double from 44 GW last year to about 100 GW by 2030.

Suzlon being the largest player in the space, and having nearly come out of its financial crisis seemed to be poised to make the most of the impending opportunity.

To be continued in next parts.