Suzlon: Stock Outlook? Part 2

In continuation of our deep dive of Suzlon, here we look at the steps Suzlon took to come out of its debt crisis and its financial situation as of 2023.

In Suzlon: Stock Outlook? Part 1, we did a deep dive into the history of Suzlon - how the stock traded at a whopping ₹400 plus figure before crashing to less than ₹10 over the next decade. We looked at the financial stress that was an outcome of the company's aggressive growth strategy together with growing interest rates due to the global financial crisis of 2008.

In this post we continue with the recovery of Suzlon and the key parameters that we feel have contributed to its recovery and continue to fuel the investor sentiments around the stock.

That which does not kill us makes us stronger

Friedrich Nietzsche

What happened with both of Suzlon's acquisitions?

We pointed out in our first post in the series on Suzlon that one of the main reasons for the stress on the company was a result of 2 large acquisitions: Hansen Transmission and Repower. Both were large global acquisitions.

The value of the transactions were massive and the operational and cultural integration of both these companies with the parent companies proved challenging.

Eventually Suzlon sold off both these units. In 2016, Suzlon divested Hansen Transmissions to Siemens for €560 million. Repower was sold in pieces to multiple buyers.

Outcome:

While the financial stress proved to be hard to get over, the acquisitions did help Suzlon get access to new technology and markets.

How did Suzlon come out of the difficult debt crisis?

- Debt Restructuring

Coming out of the debt must have required an enormous amount of negotiations, imagination, and commitment on the part of the company.

In an article dated 11th October, 2023 on the Financial Express, the paper had observed:

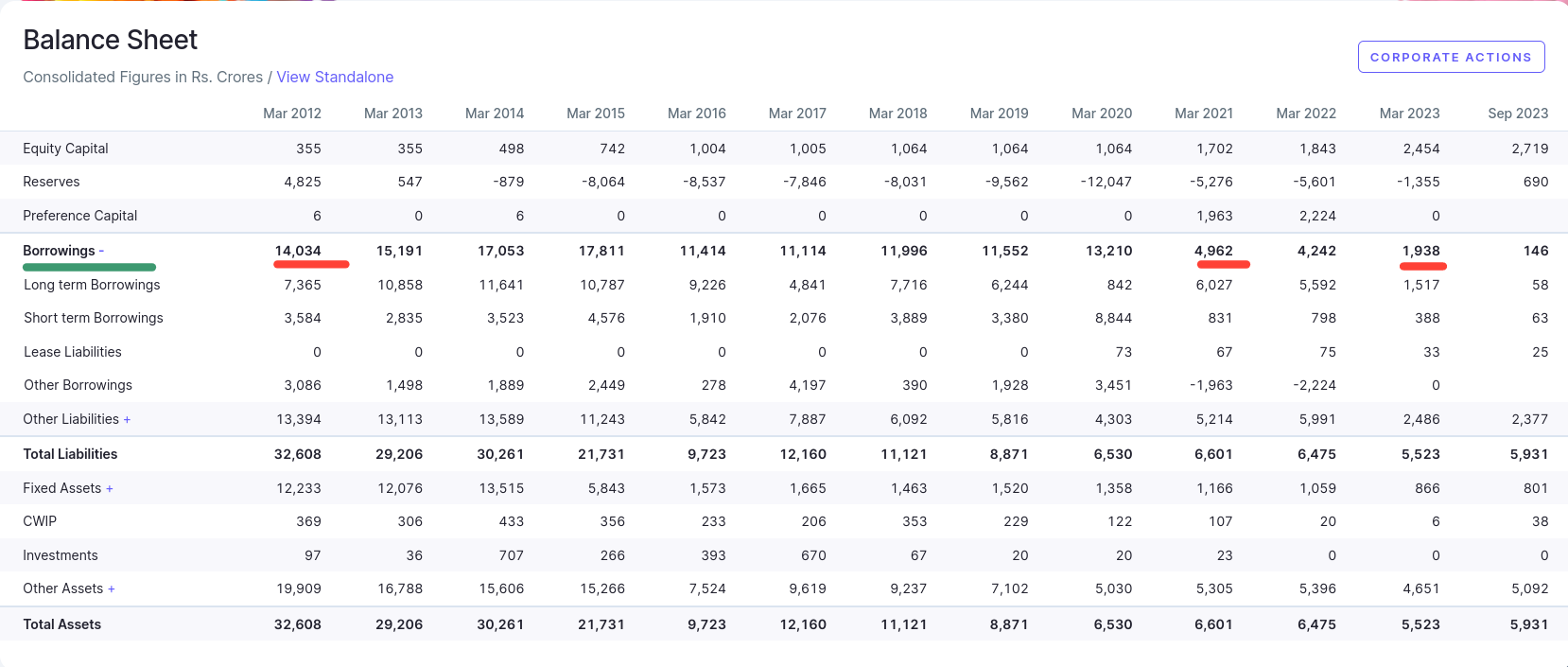

Debt levels have thus come down from Rs 11,552 crore in FY19 to Rs 1,937 crore in FY 23.

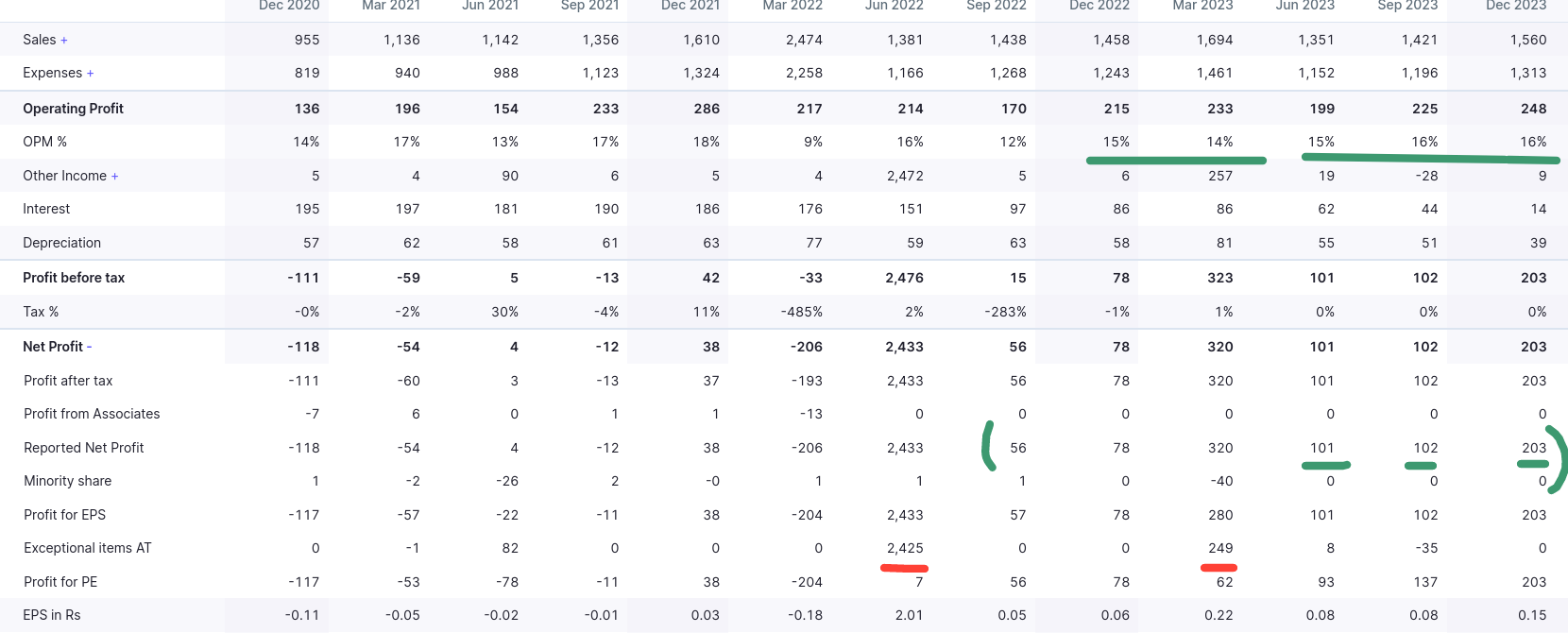

Nearly everything about Suzlon seemed to be becoming positive in 2023: strong order book, first positive PAT (Profit after Tax since 2010), strong analyst sentiments.

It seemed, Suzlon had successfully navigated through multiple rounds of debt restructuring over the decade to gradually achieve this favourable outcome. Notice the step changes under the 'Borrowings' heading over the years below.

As of September 2023, the remaining borrowings are Rs. 146 Crores only. Coming down from Rs. 17000 Crores in March 2014 this is no small achievement!

Himanshu Mody, Chief Financial Officer, Suzlon Group, said, “On the back of a successful QIP conclusion in August 2023, the journey of making our company debt-free has been completed, thereby leading to a further reduction in quarterly net finance cost by ~61% YoY. Read more: https://www.mercomindia.com/suzlon-net-profit-q3-debt-free

- Acquisition Sales and Divestment

We already pointed out above that at a point Suzlon made some tough choices and decided to sell off the two major acquisitions. The decisions surely would have been very difficult but looks like the management was strong enough to accept its mistake and continue on the path of recovery.

- Rights Issue and Equity Raise

Suzlon undertook a Rights Issue and Equity Raise in October 2022 to help improve their financial health. Suzlon issued 240 crore new shares with a face value of Rs. 2 each at a price of Rs. 5 per share (including a premium of Rs. 3). This translates to a total issue size of Rs. 1,200 crore.

The aim was to raise capital specifically for debt repayment and pre-payment of a portion of their outstanding borrowings.

Suzlon also conducted a Qualified Institutional Placement (QIP) alongside the Rights Issue.

The company closed the QIP just a day after its launch receiving bids worth Rs 4600 Crores for its Rs 2000 Crore issue!

READ More: Suzlon closes QIP after getting bids worth Rs 4,600 crore for Rs 2,000 crore issue: Exclusive

- Improved operational performance

From its financial results, it seems the company focused and did well on business operational parameters. The history of quarterly results are below. You may consult them in more details on Screener or any equivalent website.

Macro Economic Outlook

In the meantime, while Suzlon worked on coming out of debt, the government focus on Renewable energy increased. The Modi government expressed commitments to renewable energy and the projected contribution of wind energy to India's overall energy capacity is expected to double from from 44 GW to 100 GW by 2030.

In the next post, we will take a look at the macro picture that is setting the background against which opportunities for Suzlon and rest of the Industry should be evaluated,

References:

- Suzlon charts a strong path post debt restructuring, Raghavendra Kamath, Oct 11, 2023

- Suzlon takes net profits up by 82% YoY in Q2, reports debt-free balance sheet, Arjun Joshi, Mercom India, Nov 2, 2023

- Suzlon Launches QIP to raise up Rs. 2000 Crores, Swaraj Dhanjal, Economic Times, August 10, 2023

- Suzlon closes QIP after getting bids worth Rs 4,600 crore for Rs 2,000 crore issue: Exclusive, Nimesh Shah, CNBCTV18, August 16, 2023

- Suzlon concludes Hansen sale; receives Rs. 890 cr., Suzlon Press Release, October 13, 2011

- Suzlon Energy to sell Hansen Transmissions stake for Rs 830 cr, July 26, 2011, Economic Times

- Suzlon Energy sells 100% stake in German subsidiary Senvion to Centerbridge Partners, April 30, 2015, Economic Times