Suzlon: Stock Outlook? Part 3

How is the Indian Energy sector poised to perform over the next 6 years? What is government of India's Panchamrit objectives? And how we anticipate Suzlon to take shape.

As a follow up to the first 2 posts on Suzlon and its past, we shall dive into the Indian Energy sector and the role that Suzlon is likely to play over the next 6 years.

How does the Indian Energy market look today?

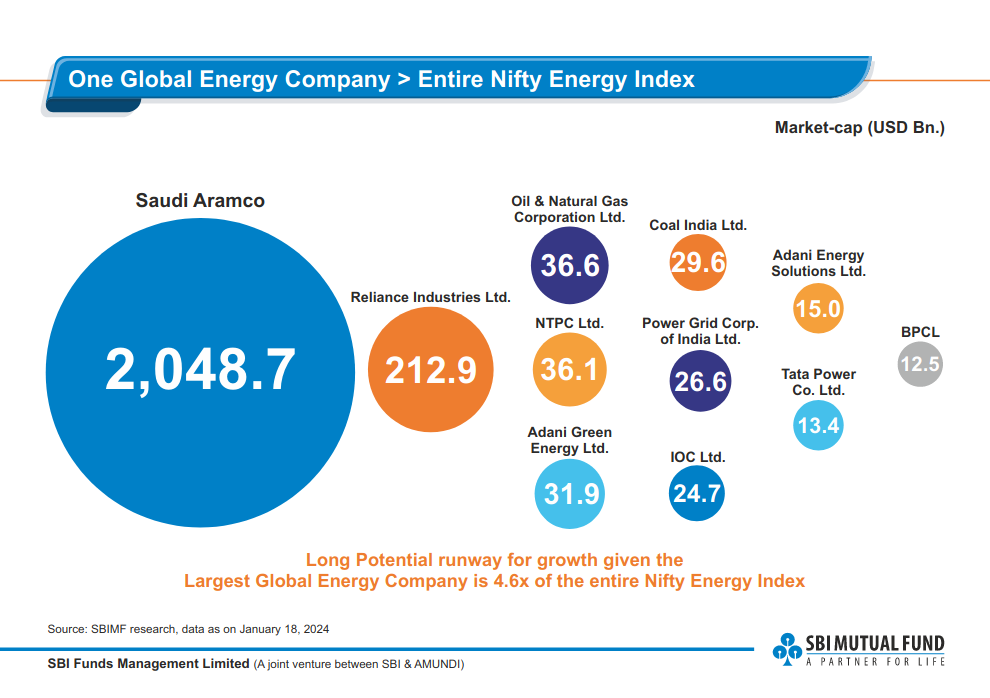

One Global Energy company, Saudi Aramco, is 4.6 times the entire Nifty Energy Index!

This is mind boggling.

This implies purely from a geopolitical standpoint, the Energy sector is perhaps one of the most critical sectors for the Government of India to focus on.

The Indian Government has stressed it's focus on Renewable Energy repeatedly. This naturally means the next 6 years will see a combination play of focus on two pillars:

(a) Traditional Energy: Fossil fuels, though with a reducing focus, the market will continue to grow since it will take some amount of time before the shift to Green Energy will successfully happen.

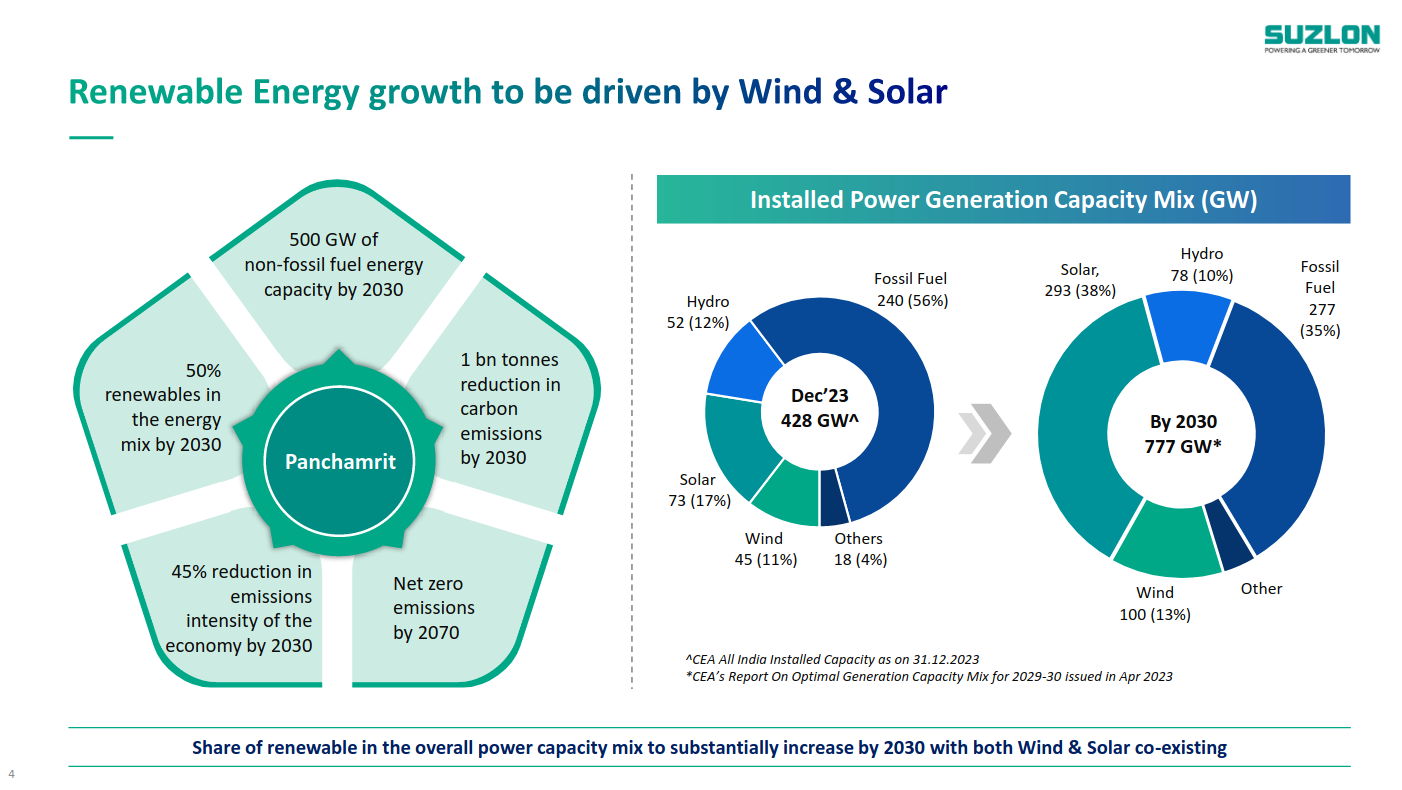

(b) Renewable / Green Energy: Solar, Wind, Hydro energy that is expected to grow at a much larger speed in comparison, and per government plans, will be anticipated to cater to 50% of capacity by the year 2030. This figure will be around 500 GW up from a figure of 180 GW presently.

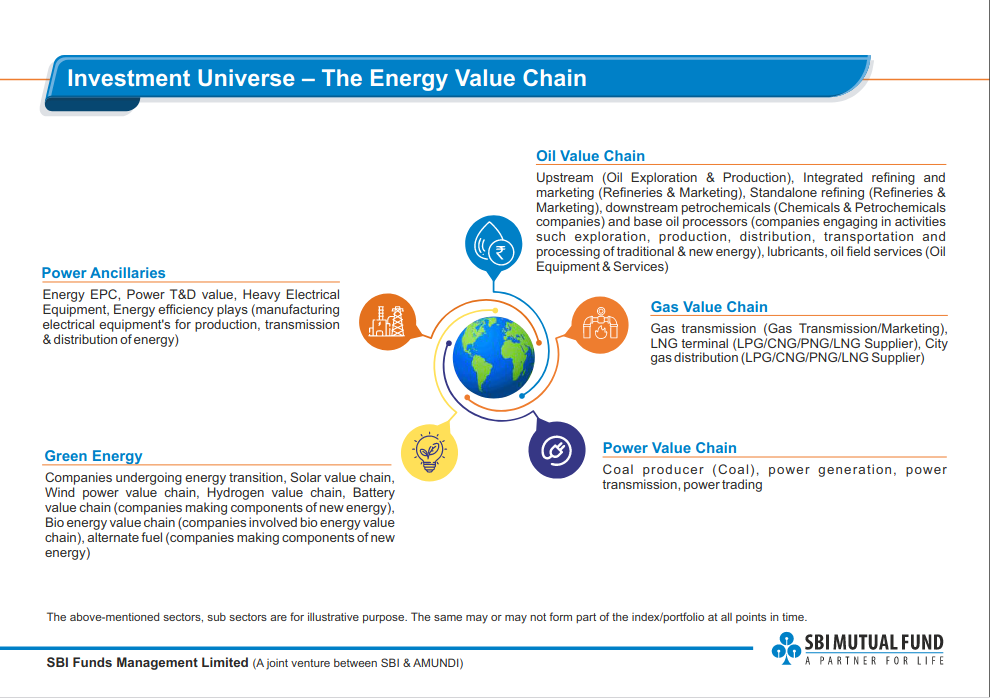

The Indian Energy investment space looks something like this:

What is the future of Wind Energy in this story?

To understand the opportunity that the Wind Energy sector holds in this context, let us take a glance at Suzlon's Q3 2024 investor presentation here.

What is Panchamrit?

Panchamrit refers to India's five-point climate action plan unveiled by Prime Minister Narendra Modi at the United Nations Climate Change Conference (COP26) in Glasgow in 2021. Panchamrit translates to "five nectars" and each point highlights India's commitment to tackling climate change. Here's a breakdown of the five goals:

I. Reaching 500 GW of Non-Fossil Fuel Capacity by 2030: This ambitious target aims to significantly increase India's reliance on renewable energy sources like solar and wind power.

II. Meeting 50% of Energy Requirements from Renewable Energy by 2030: This goal focuses on generating half of India's total energy needs from clean sources by 2030.

III. Reducing Carbon Intensity of GDP by 45% by 2030 (compared to 2005 levels):This target aims to decrease the amount of carbon dioxide emitted per unit of economic output (GDP).

IV. Achieving Net Zero Emissions by 2070:This is India's long-term goal of achieving carbon neutrality, balancing emissions with removals, by 2070.

V. Reducing Projected Carbon Emissions by 1 Billion Tonnes from Now to 2030:This is a specific short-term target to bring down India's overall carbon footprint.

What are the investor sentiments in this context?

In the above context the sentiment on the Renewable / Green energy side is optimistic. India's largest conglomerates have asserted their commitments to clean energy and as such we have seen stock prices of a number of such companies race.

Based on preliminary research, here is how major Indian conglomerates are viewing the sector:

Adani Group

Company Name: Adani Green Energy Ltd (AGEL)

Focus Area: Solar energy is their primary focus, with a rapidly growing portfolio. They also have some wind energy projects.

Ambition: Aim to be the world's largest solar company by 2025 and the largest renewable energy company by 2030.

Tata Group:

Company Name: Tata Power Renewable Energy Ltd (TPREL)

Focus Area:

Operates a mix of solar and wind energy projects, with a growing emphasis on solar.

Strategy: Aims to achieve 30-40% of their total generation capacity from clean energy sources.

Reliance Industries:

Company Name: Reliance New Energy Ltd (RNEL)

Focus Area: Broader focus on clean energy, including solar, hydrogen, and battery storage solutions.

Strategy: Aims to be a major player across the entire clean energy value chain.

Mahindra Group:

Company Name: Mahindra Renewables

Focus Area: Primarily wind energy, with a growing presence in solar power as well.

Strategy: Committed to becoming a leading renewable energy independent power producer (IPP).

These are a few major names amongst multitude of players who have become very active in the green energy space.

What role is Suzlon expected to play by 2030?

If you refer to the infographic above, you will see the Wind Energy sector is expected to jump from its current capacity of 44 GW to 100 GW by 2030. The contribution of Wind Energy in the overall capacity is set to increase from 11% to 13% in the next 6 years per government plans. Of course, these are the plans - the success of this is dependent on the efficiency of execution.

Today Suzlon also has 32% of the Wind Energy market share in India. It is the largest player in this sector. It has 20.5 GW of installed capacity globally with a 6000+ workforce.

As we have seen in the previous two deep dive articles on Suzlon, it seems to have solved its debt crises.

Suzlon also seems to have a healthy order book already. And the management of Suzlon has been persistent and ambitious.

As such, we feel it is logical that with the macro economic picture pointing to a favourable future for the Wind Energy, it is likely that Suzlon will do well in the coming years.

However, again - this is not to be taken as an investment advice. This is the broad framework we have used in developing our view of Suzlon. I am sure there are many other factors that we may lack sight of, and as such you MUST do your own research, and perhaps seek professional advice as you deem necessary.