The Impact of Maharashtra Election Results on Indian Markets: An In-Depth Analysis

Table of Contents

Introduction

Understanding the Political and Economic Landscape of Maharashtra

Historical Context: Past Elections and Market Trends

Election Results: Key Highlights and Outcomes

Immediate Market Reactions and Analysis

Sector-Wise Impact Assessment

- Banking and Finance

- Real Estate

- Agriculture

- Manufacturing

- IT and Services

Long-term Market Implications

Global Investor Sentiments and Maharashtra's Stature

The Road Ahead: Strategic Moves for Investors

Conclusion

Frequently Asked Questions (FAQs)

Introduction

The Maharashtra election results hold immense significance not just for the state but for the entire country, influencing the Indian markets in multifaceted ways. As one of the most industrialized states in India, Maharashtra is a hub for various industries ranging from banking to real estate.

Understanding the impact of its election results is crucial for investors, policy-makers, and economists attempting to forecast economic trends and allocate resources effectively. In this article, we will delve into an authoritative analysis of how these election outcomes affect the Indian market landscape.

Understanding the Political and Economic Landscape of Maharashtra

Maharashtra, home to India's financial capital Mumbai, plays a pivotal role in the country's economic framework. The state's governance has traditionally influenced national policies and economic strategies.

The political dynamics in Maharashtra can therefore lead to significant shifts in market operations, influencing everything from stock prices to foreign investments.

Historical Context: Past Elections and Market Trends

Past patterns reveal that market behavior tends to fluctuate during elections, often characterized by volatility and uncertainty. The Maharashtra elections have historically affected investor sentiments owing to policy speculations.

For instance, following the 2014 and 2019 elections, the Indian markets experienced varying degrees of impact across different sectors. Evaluating past trends helps investors and analysts gauge potential market reactions to current electoral outcomes.

Election Results: Key Highlights and Outcomes

The recent Maharashtra elections have led to a reshuffling of political powers, dictating policy directions and influencing market atmospheres. Analyzing the key outcomes provides insight into potential legislative changes and economic reforms that may impact various sectors. The election results also offer a glimpse into the political stability of the state, a critical factor for investor confidence.

Key Outcomes of the Election

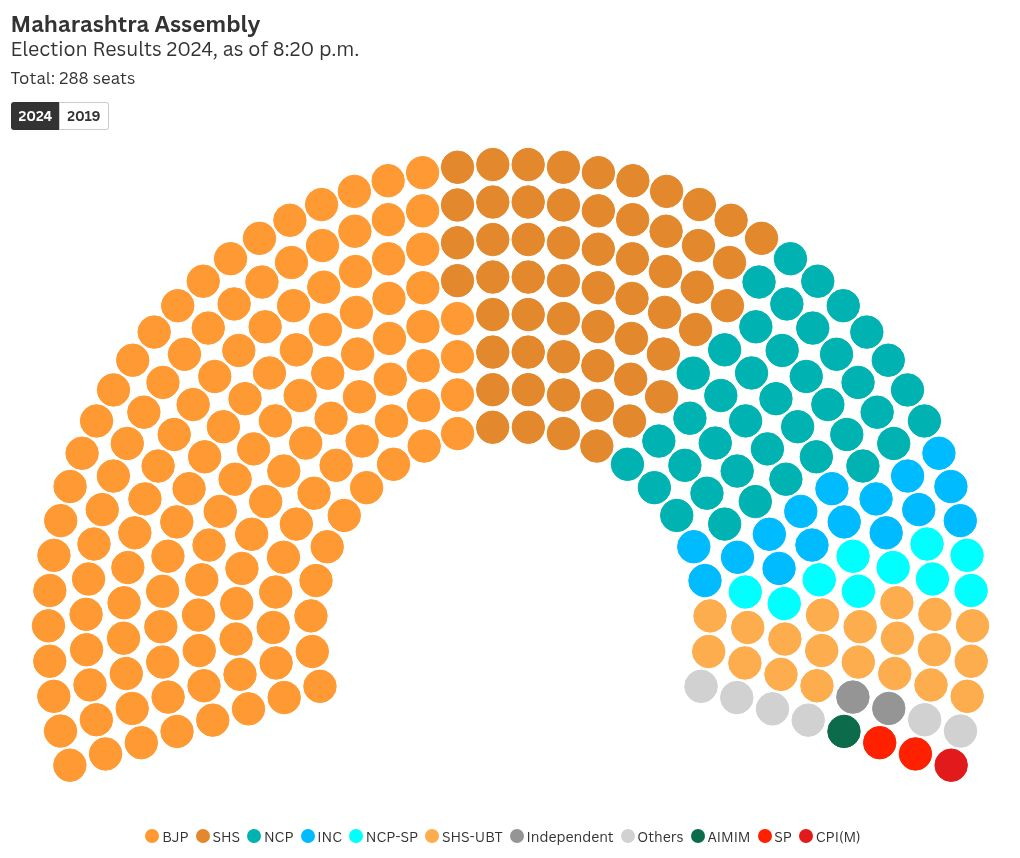

- Election Results: The Mahayuti alliance, comprising the BJP, Shiv Sena (Eknath Shinde faction), and NCP (Ajit Pawar faction), secured 233 out of 288 seats, achieving a striking 81% strike rate. This victory is seen as a strong endorsement of the coalition's governance and policies12.

- Market Reaction: Following the announcement of these results, the Indian stock market experienced a significant rebound, with indices such as the Sensex and Nifty gaining approximately 2.5% each, marking their largest single-day increase in five months13.

Implications for Market Sentiment

Positive Outlook

- Investor Confidence: Analysts predict that the stability brought by this clear mandate will boost investor confidence, particularly in sectors aligned with pro-business policies. The continuity in governance is expected to foster a favorable environment for investments in infrastructure, urban development, and manufacturing sectors24.

- Sectoral Gains: Key sectors likely to benefit include:

- Infrastructure and Real Estate: With a focus on infrastructure projects, there is potential for increased investment in construction and real estate45.

- Banking and Finance: As Mumbai is India's financial capital, the stability is expected to attract both domestic and foreign investments into banking and financial services45.

Market Predictions

- Short-Term Projections: Market analysts anticipate that indices could rise by 1% to 1.5% in early trading sessions following the election results. The Nifty index is projected to target levels between 24,400 and 24,50025.

- Technical Indicators: The Nifty has shown strong support at around 23,200, with a bullish trend reversal indicated by recent technical formations. Immediate resistance levels are noted at 24,030, with potential upward movement towards 25,000 if these levels are breached13.

Risks and Challenges

Despite the optimistic outlook, several risks could temper market enthusiasm:

- Global Economic Factors: Geopolitical tensions (e.g., between Russia and Ukraine), rising crude oil prices, and a strengthening dollar continue to pose challenges. These factors have led to significant foreign portfolio investor (FPI) outflows amounting to approximately ₹1.55 lakh crore over recent months24.

- Earnings Concerns: Weak corporate earnings reports may also dampen market performance in the short term. Investors remain cautious about how these external pressures will influence domestic economic conditions23.

Sector-Wise Impact Assessment

Banking and Finance

Financial institutions are usually quick to react to political changes, with banking stocks often witnessing volatility based on anticipated monetary policies and financial regulations introduced by the new administration.

Real Estate

Maharashtra's real estate market, particularly in urban areas like Mumbai and Pune, could experience fluctuations stemming from new housing policies and infrastructural development plans proposed by the emerging government.

Agriculture

As agriculture is fundamental to Maharashtra’s economy, election outcomes can significantly influence market predictions for this sector. Government initiatives affecting farming subsidies, crop insurance, and rural development are areas to watch.

Manufacturing

The state’s manufacturing sector hinges on industrial policies and labor laws. Political stability and industrial-friendly policies announced by the new government can bolster investor confidence in manufacturing stocks.

IT and Services

A focus on IT and service sector reforms, including digital policy revisions and foreign investment aspects, will determine market responses in these highly growth-oriented sectors.

Long-term Market Implications

Beyond immediate reactions, the long-term impact of Maharashtra's election results on markets can influence economic trajectories.

Economic reforms promised during elections, such as infrastructural investments and policy shifts, can stimulate or stifle market growth over time. Investors should consider these long-term strategies when planning portfolios.

Global Investor Sentiments and Maharashtra's Stature

The global investor community closely watches elections in key Indian states like Maharashtra, as these results can affect India’s appeal as a stable investment destination. The political climate post-elections might sway global investment flows into or out of the country.

The Road Ahead: Strategic Moves for Investors

In light of the election results, investors might need to recalibrate their strategies, considering the potential policy changes and economic forecasts. Diversification, risk assessment, and sector-specific investment opportunities should be part of a dynamic approach to navigating market uncertainties.

Conclusion

The Maharashtra election results are more than a political event; they are a determinant of market directions and economic policies across India. Understanding their impact is crucial for investors, businesses, and policymakers who need to align their strategies with the changing political and economic landscape.

Analysis of immediate reactions, sector-wise influences, and long-term projections provides a comprehensive approach to foresee and manage market risks.

Frequently Asked Questions (FAQs)

1. How do Maharashtra election results impact the Indian economy?

The election results influence economic policies, investor sentiments, and market stability, which, in turn, affect economic growth and development across India.

2. Which sectors are most affected by the Maharashtra election results?

Key sectors impacted include banking, real estate, agriculture, manufacturing, and IT services, depending on policy changes and political stability.

3. How can investors manage risks following opaque election outcomes?

Investors should focus on diversifying portfolios, assessing risk, staying informed on policy developments, and consulting with market analysts and financial advisors.

4. Why are global investors concerned with Maharashtra's election results?

As a major economic center, political developments in Maharashtra can influence India’s overall investment climate, affecting global investment strategies.

5. Can election results cause long-term market volatility?

Yes, electoral outcomes can lead to policy changes and economic reforms, potentially causing prolonged market volatility as new administrations establish their governance and policy agendas.