US Stock Market Outlook for 2024

2024 is more likely to be an average year for markets than a double-digit winner. Find out why and what it means for your portfolio.

Analysts in early 2024 were generally optimistic, expecting continued growth in earnings, low-interest rates, and healthy valuations. This optimism came after a strong 2003, where the market rebounded significantly from a previous downturn.

Overall Performance

The US stock market in 2024 ended up being a year of moderate growth so far.

- The Dow Jones Industrial Average rose by 3%.

- The Nasdaq composite index also saw an increase of nearly 9%.

- The S&P 500, a broad market index, gained around 9% for the year.

Sector Performance in 2024 so far

For the year ahead, which sectors lead and which lag may depend in large part on macroeconomic considerations, which are hard to predict.

- In the first 2+ months of 2024, S&P 500 energy sector stocks rose 6.39%, somewhat underperforming the broader S&P 500’s return of 7.61%.

- Health Care and Information Technology were the laggards, with gains of only 0.23% and 2.14% respectively.

- If the US avoids a recession and achieves a soft landing, then sectors that do well in cycles like materials, industrials, and consumer discretionary could take the lead.

- If recession finally does happen, then defensive sectors like health care, utilities, and consumer staples could come into favour.

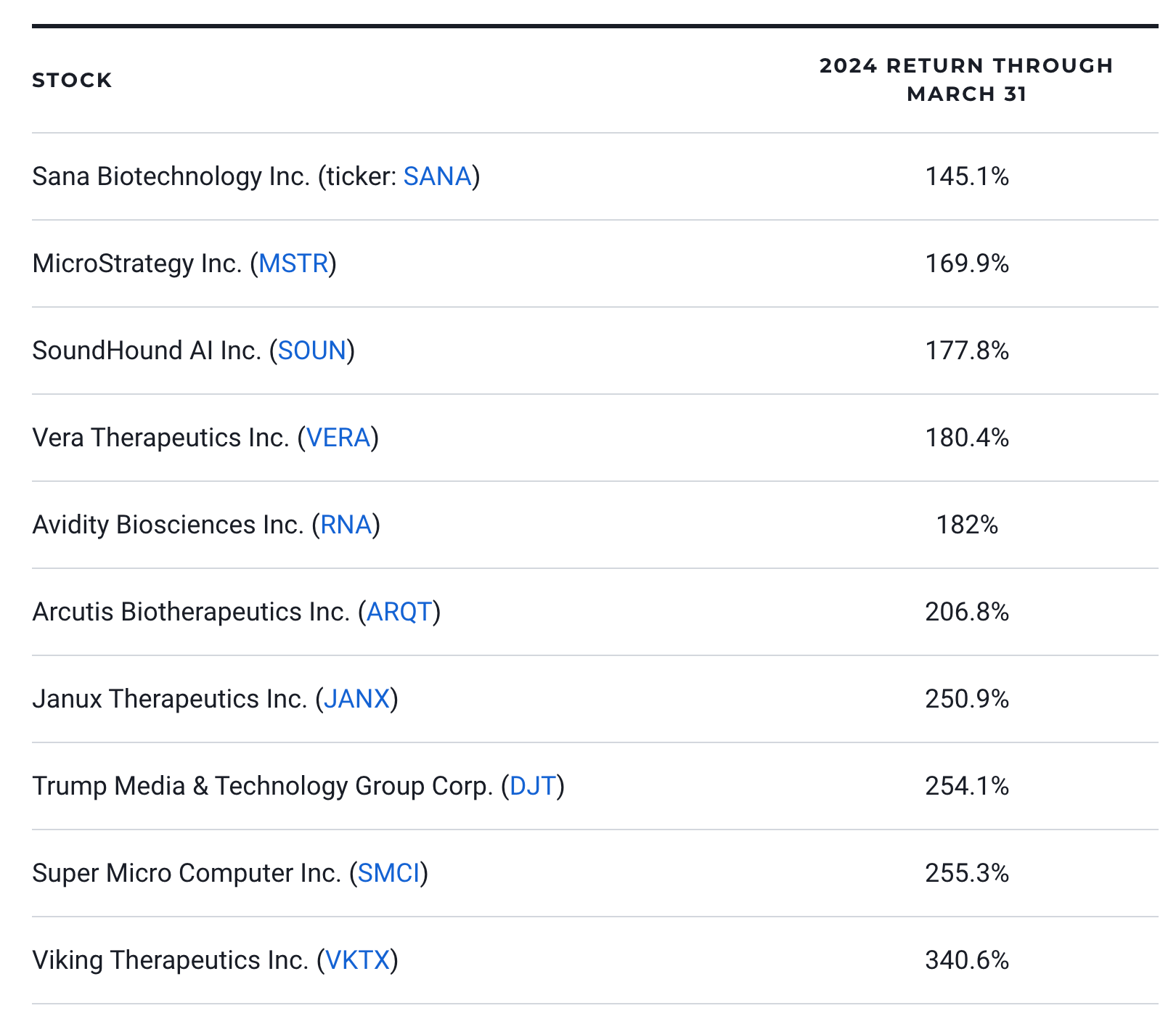

Stock Performance in 2024 so far

Here are the 10 best-performing stocks of 2024 (first quarter) among companies that trade on major U.S. exchanges and have market capitalizations of at least $1 billion

So what does this mean for investors? Should you invest in US stock markets in 2024?

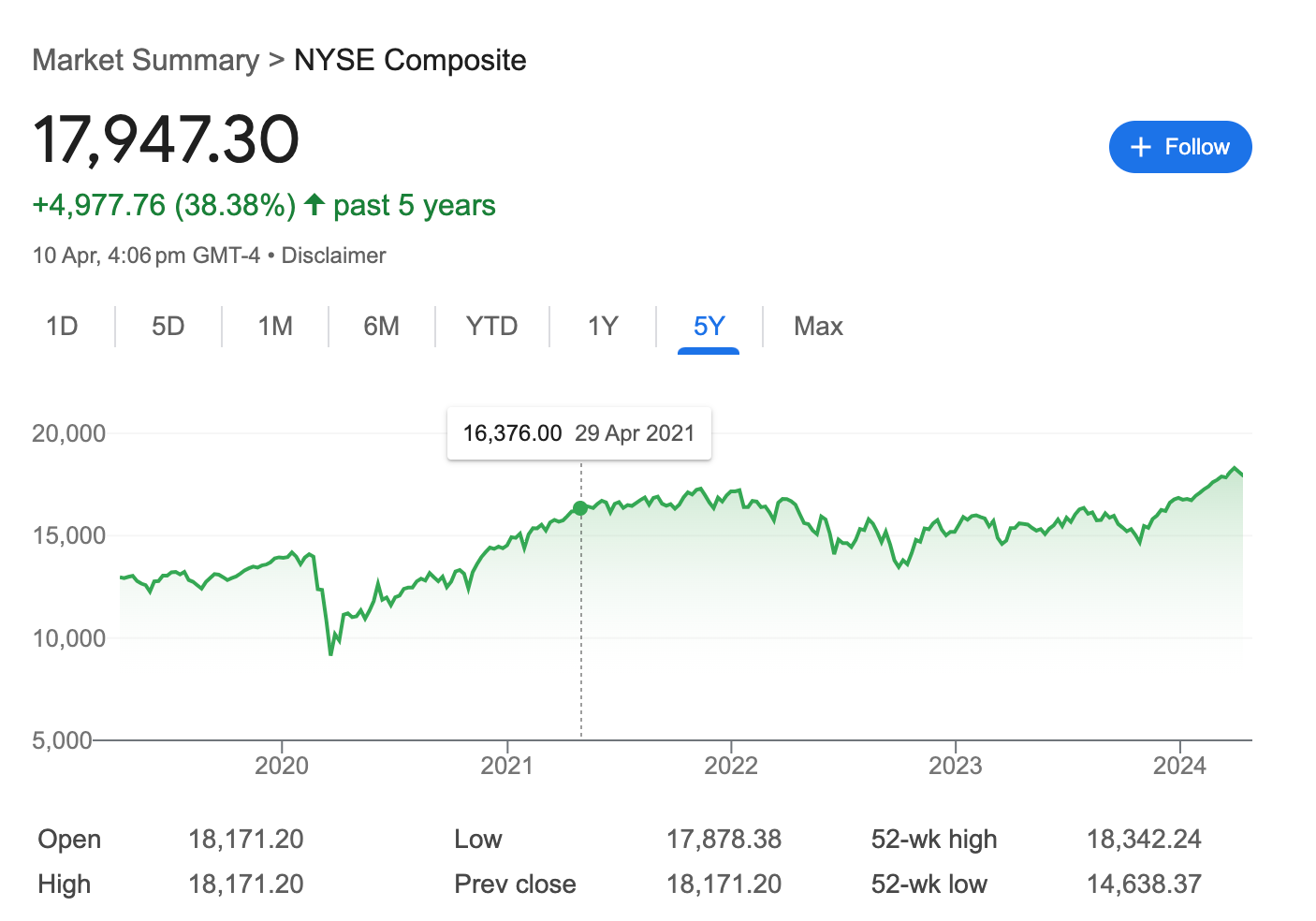

As it stands now in April 2024, the NYSE composite Index has grown by over 38% in last 5 years.

This situation is not generally considered a good entry point though ☹️ There is no certainty that prices will come back down to earth anytime soon though.

While there is sense in waiting to “buy the dip”, the safest approach is to invest into the market on a weekly or monthly basis and gain from the dollar cost averaging than investing lump sum.

Here are three options you can explore to investing in US Stocks

- The first option is to buy an index fund such as the S&P 500 or Nasdaq 100. This gives you exposure to index and you will do as well as the market. Over long multi-year timeframes you are highly likely to make a good profit by taking this approach.

- Your second option is to buy an actively managed fund. A portfolio manager will select a group of US stocks for you that they believe will outperform the broader market.

- The third way is to buy individual company shares. Most Indian investment platforms allow you to buy US stocks in a very similar way to Indian shares.

Conclusion

As per forbes.com,

Wall Street analysts' consensus estimates predict 3.6% earnings growth and 3.5% revenue growth for S&P 500 companies in the first quarter. Analysts project full-year S&P 500 earnings growth of 11.0% in 2024, but analysts are more optimistic about some market sectors than others.

As far as, we're concerned, an 11% annual growth is not bad 😃

We recommend studying the individual sectors and choosing to invest in stocks of the sectors you understand and fill confident on.

Stick to buying index funds so you grow with the index and don't invest lump sum amounts. And you should be good.

Happy investing! 😄