After Market Orders: Learn about AMOs

Learn about the basics of After Market Orders (AMOs), what do they mean and how you can use them.

Have you heard of the term 'AMOs' or After Market Orders? In this post, we deal with what AMOs are, what is their significance, how you can place them and how you may benefit from them.

What are After Market Orders?

After Market Orders or AMOs are orders that are placed by investors outside of normal trading hours. Of course, the trading hours vary with specific exchanges. For example, in the National Stock Exchange (NSE) the trading hours are between 9 15 AM to 3 30 PM. Brokers in India generally allow placing AMOs through their respective portals.

When can AMOs be placed in the market?

Orders placed outside of the trading hours (9 15 AM to 3 30 PM on weekdays have to be placed as AMOs. So, you can place them after 3 30 PM and before 9 15 AM the following day, before the trading actually begins.

What are types of AMOs?

Similar to regular orders, AMOs can also be:

- Limit orders: Your order will carry a specific price at which the trade will be executed, if there is a matching order to fulfill your trade against.

- Market orders: Your orders will be executed with the best available market price.

- Stop orders: A stop order is an instruction to your broker to automatically buy or sell a security once the stock price reaches a specific trigger price.

How can you use AMOs?

- AMOs are particularly useful if you are busy during market hours and find it difficult to trade at the time. Working professionals sometimes prefer placing AMOs the day prior. Especially when they do not have the time to actively monitor the market.

- Investors might use AMOs to try and buy or sell at a specific price that might be available during the pre-market or after-market sessions. However, there's no guarantee the desired price will be reached. Still the fluctuations during preopen sessions are significant and can reach levels they would not normally reach during market hours.

- If there's important news released after-hours that might affect a stock price, investors can use AMOs to react to the news before the market opens for trading the next day.

Things to keep in mind with AMOs

There are 3 important things that you should keep in mind while dealing with AMOs:

- Pre-market and after-market sessions can be more volatile than regular trading hours. This means prices can fluctuate more significantly, potentially leading to unexpected outcomes for your AMO.

- Unlike regular market orders, there's no guarantee that AMOs will be filled at the desired price. This is because there might not be enough buy or sell orders at the specified price point during the pre-market or after-market sessions.

- Some brokers might charge additional fees for placing AMOs.

How to place an AMO?

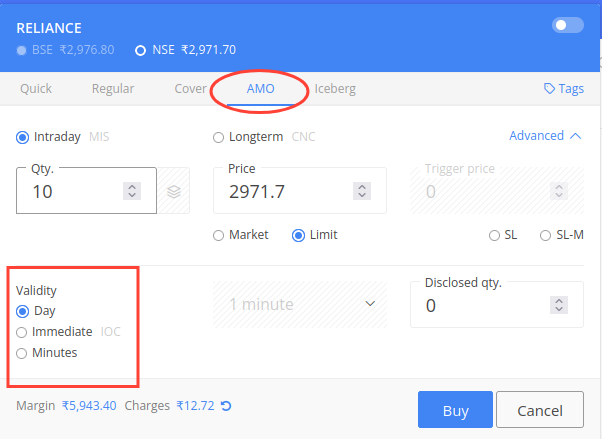

Placing an AMO order is not very different than placing a regular order. Except that you have to mark the order as an AMO.

Look at the order screen for placing a Zerodha AMO below:

Summary

Overall, AMOs can be a useful tool for investors who want to place orders outside of regular trading hours. However, it's important to understand the limitations and potential risks involved before using them.