Commonly asked questions on the fundamentals of Suzlon?

Answers to some of the commonly asked questions on Suzlon Energy. Is Suzlon profitable? Is Suzlon debt free? What experts think of Suzlon's performance?

In this article, we will try to answer common fundamental questions on Suzlon per our understanding. Our objective is to present figures and articles that you may refer to, with running observations to simply assist in reading them.

Is Suzlon debt free?

In August, 2023, the CFO of Suzlon said, "On the back of a successful QIP conclusion in August 2023, the journey of making our company debt-free has been completed, thereby leading to a further reduction in quarterly net finance cost by ~61% YoY" (Read here).

While we do not have the technically correct answer for if there are pending debts on Suzlon's books. It is natural for a company at Suzlon's scale to naturally have debts. However, here we are referring to the debt crisis triggered by the financial crisis of 2008 that Suzlon underwent through.

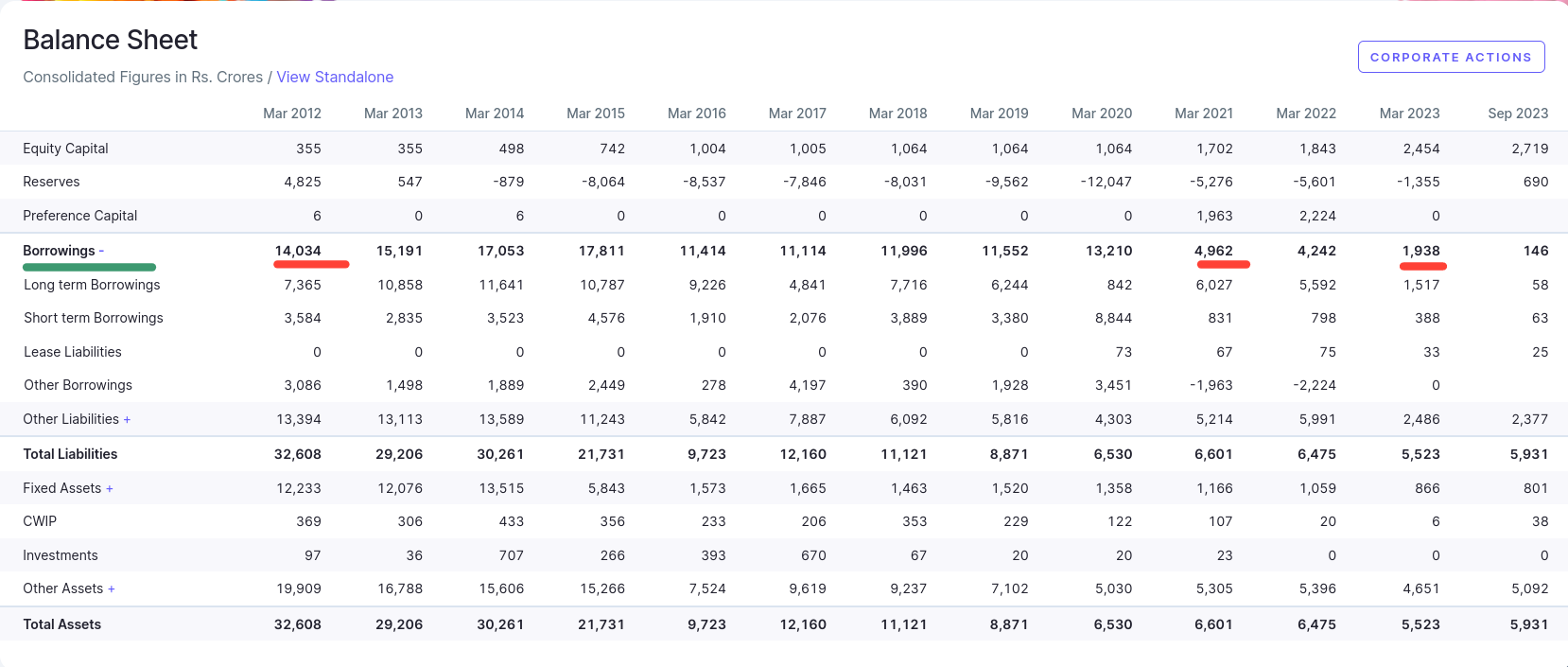

Let us take a look at their year end balance sheet figures since 2012.

How much profit does Suzlon make?

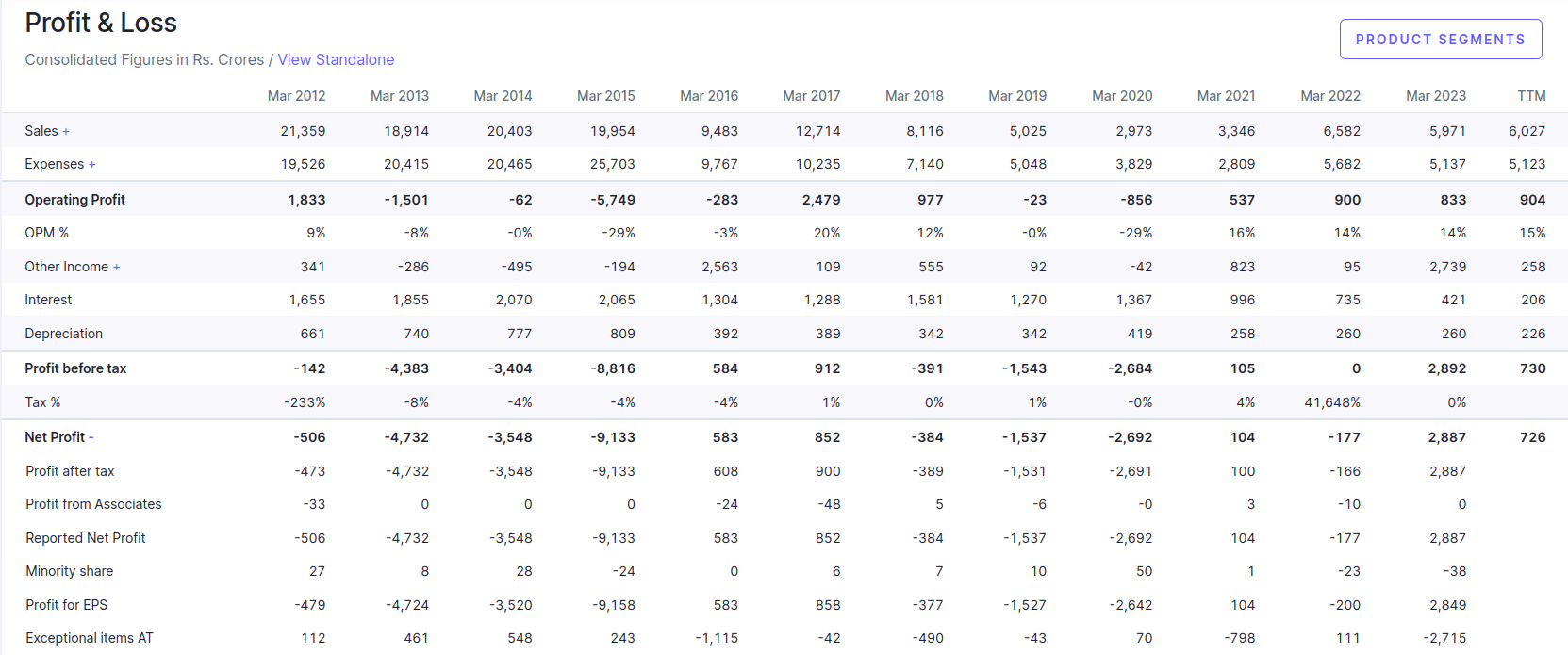

Let us take a look at the Profit and Loss statements since 2012.

If we look at the PAT (Profit after Tax) figures of Suzlon. You would notice the PAT of Suzlon becoming positive since 2016, and then since 2021. While we are not aware of circumstances during 2016-2017.

March 2023 did have an Exceptional Item of Income INR 2,719 crores which will perhaps not recur. We documented here the order book of Suzlon in this quarter per information available from the Suzlon official website. The order book is likely to influence the earnings and profits in coming quarters and years.

What experts say of Suzlon Energy?

Per a Business Today article on the 12th of April, 2024, Anand Rathi is optimistic on the results of Suzlon Energy. To quote,

"Anand Rathi recently initiated coverage on Suzlon Energy and Inox Wind with 'Buy' ratings, thanks to renewed focus on the wind-energy sector amid ambitious growth plans by the government."

For the March quarter, Anand Rathi is expecting an adjusted profit of Rs 262.20 crore, up 283 per cent for Suzlon. Sales are seen rising 52.4 per cent YoY to Rs 2,581.70 crore. However, the EBIDTA margin is expected to be at 12.6 per cent against 15.9 per cent in December and 13.7 per cent in the same quarter last year.

If you have not already, do read through our post on the order book of Suzlon as collated from their website.